The Journal Entry To Adjust Supplies Is

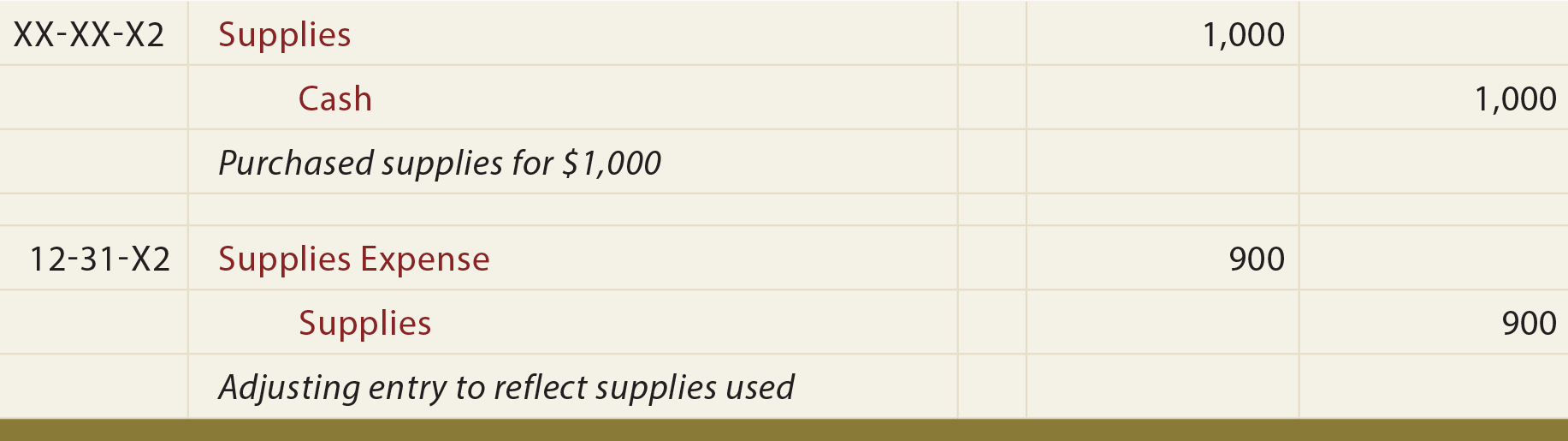

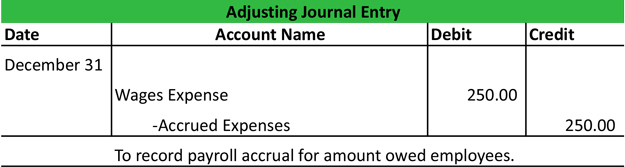

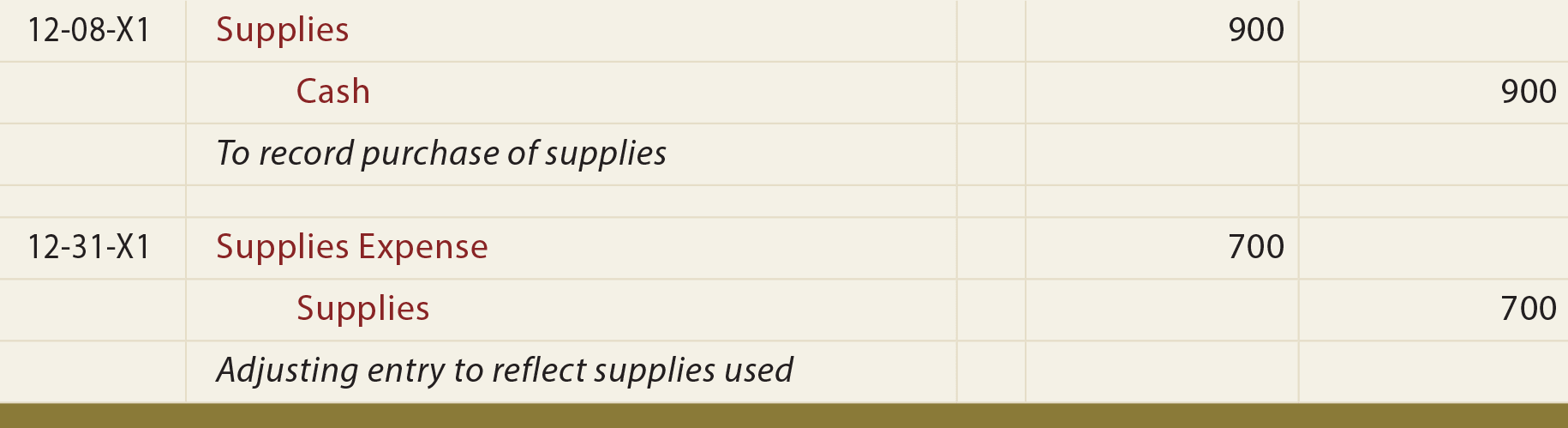

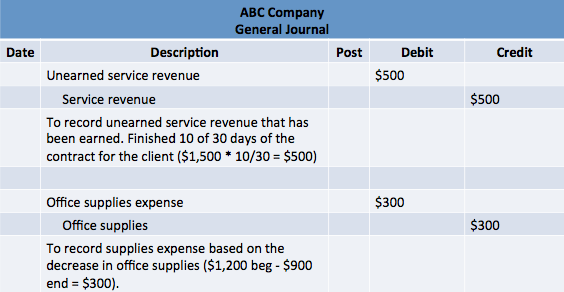

The physical inventory is used to calculate the amount of the adjustment. The adjusting entry for Supplies in general journal format is.

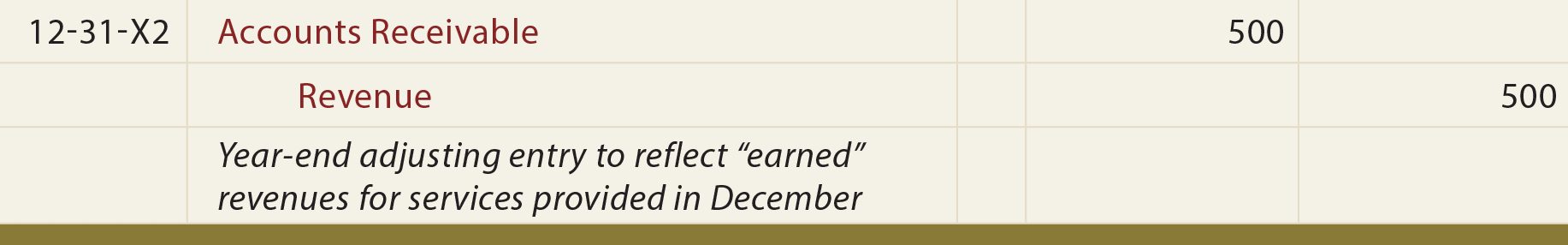

The Adjusting Process And Related Entries Principlesofaccounting Com

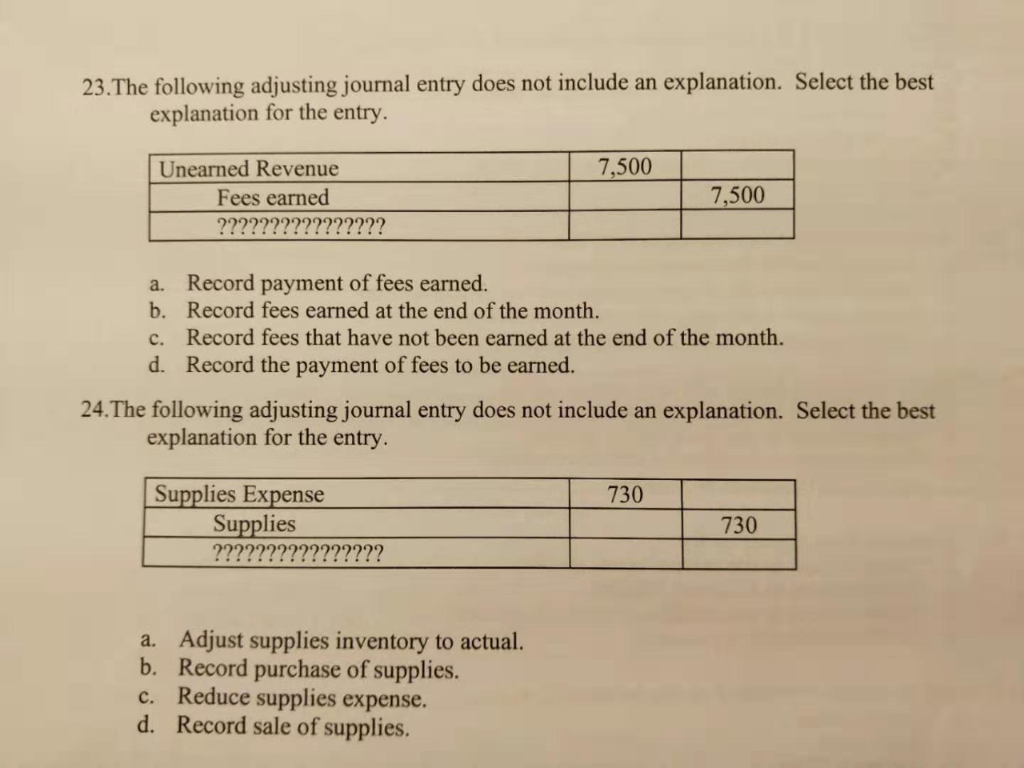

Which of the following does not correctly describe an adjusting journal entry that debits supplies expense and credits supplies.

The journal entry to adjust supplies is. For example if the supplies account had a 300 balance at the beginning of the month and 100 is still available in the supplies account at the end of the month the company would record an adjusting entry for the 200 used during the month 300 100. Likewise the office supplies used journal entry is usually made at the period end adjusting entry. For example if the supplies account had a 300 balance at the beginning of the month and 100 is still available in the supplies account at the end of the month the company would record an adjusting entry for the 200 used during the month 300 100.

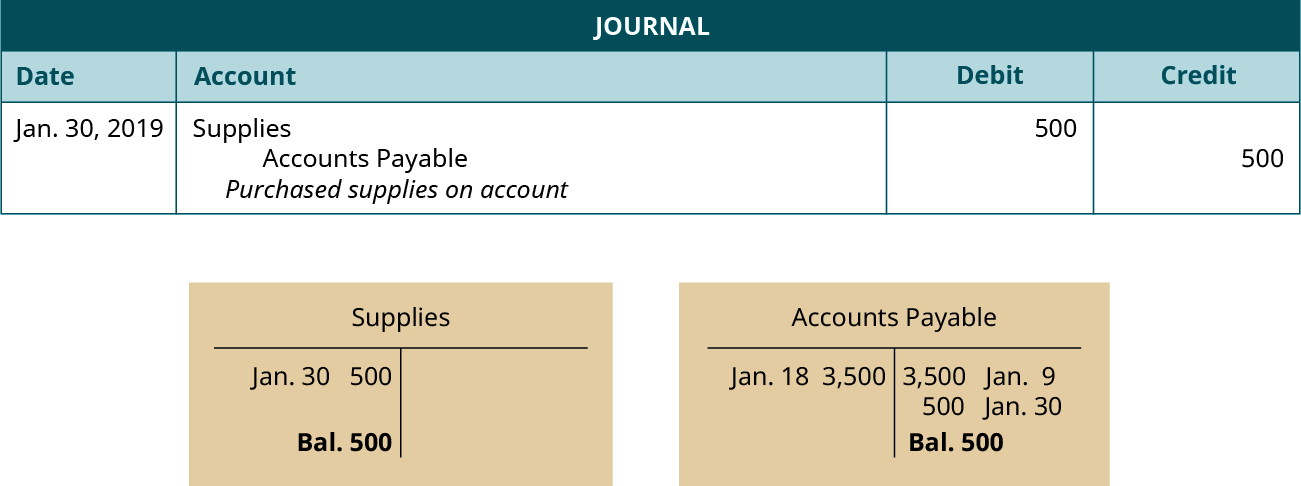

An adjusting entry is used to record the amount of supplies used supplies expense during the period. This entry is made as follows. The journal entry is given below.

When a company purchases supplies the cash account is credited and the supplies account is debited for the same amount. At the end of the period the company counts up what is left for supplies. The Journal entry to update the Office Supplies account for office supplies used is which of the following types of adjusting entry.

A physical inventory is typically taken once a year and means the actual amount of inventory items is counted by hand. To determine the amount of supplies used during the period a physical count is made of the supplies remaining or on hand. The adjusting journal entry we do depends on the inventory method BUT each begins with a physical inventory.

Supplies on hand adjusting entry. At the end of the accounting period the cost of the supplies used during the period is computed and an adjusting entry is made to record supplies expense. The Green Company purchased office supplies costing 500 on January 1 2016.

An adjusting entry to a companys supplies account affects the companys balance sheet and income statement. The entry increases expenses and decreases assets. This is a video example of how to record an adjusting entry for supplies adaptable to any prepaid expenseProfAlldredge For best viewing switch to 1080p.

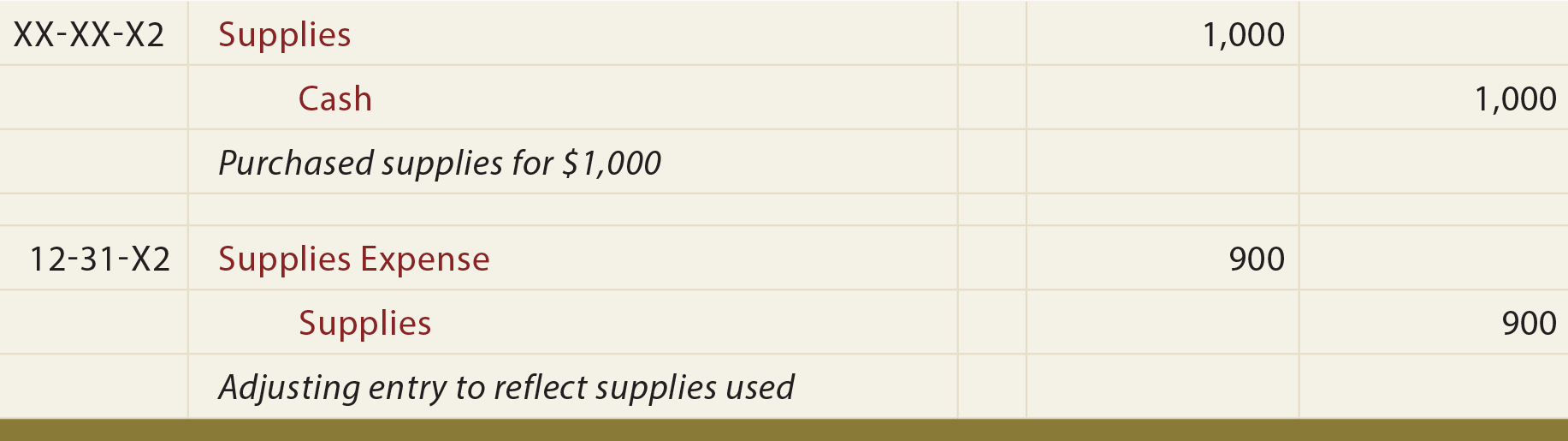

Adjusting journal entries are accounting journal entries that update the accounts at the end of an accounting period. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. Out of which supplies costing.

Any hours worked in. Not an adjusting entry. The difference between the balance in the account unadjusted and the amount that is left adjusted is the value used in the journal entry.

Generally adjusting journal entries are made for accruals and deferrals as well as estimates. Notice that the ending balance in the asset Supplies is now 725the correct amount of supplies that the company actually has on hand. Example 4 The balance in the supplies account at the end of the year was 5600.

Each entry impacts at least one income statement account a revenue or expense account and one balance sheet account an asset-liability account but never impacts cash. With an adjusting entry the amount of change occurring during the period is recorded. An adjusting entry must be recorded in the companys general journal to indicate the amount of supplies used in a given period.

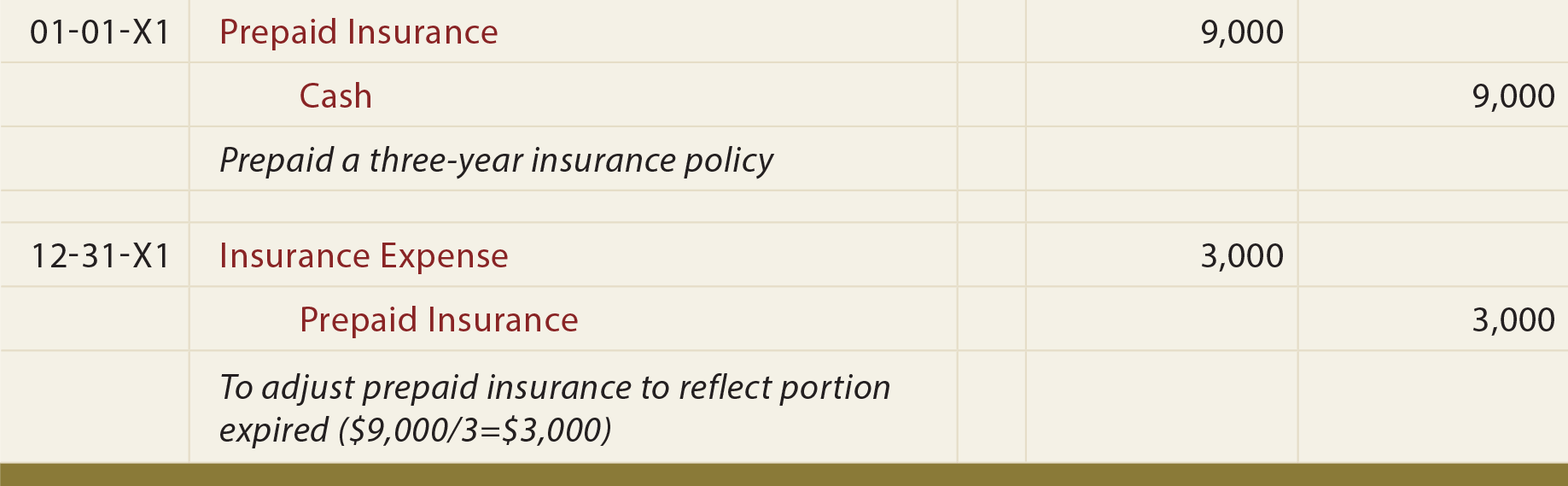

Adjusting entry at the end of accounting period. Adjusting Entries 20--June 30. The adjusting journal entry for Prepaid.

With an adjusting entry the amount of change occurring during the period is recorded. Supplies expense Beginning supplies on hand Purchases - Ending supplies on hand Supplies expense 1200 400 - 900 Supplies expense 700. This supplies expense would be recorded with the following journal.

At the period end adjusting entry the company usually counts the remaining office supplies in order to determine the supplies used during the period. We can use the following formula for supplies expense. It is a result of accrual accounting and follows the matching and revenue recognition principles.

The entry decreases net income and decreases assets. The income statement account Supplies Expense has been increased by the 375 adjusting entry. Payroll is the most common expense that will need an adjusting entry at the end of the month particularly if you pay your employees bi-weekly.

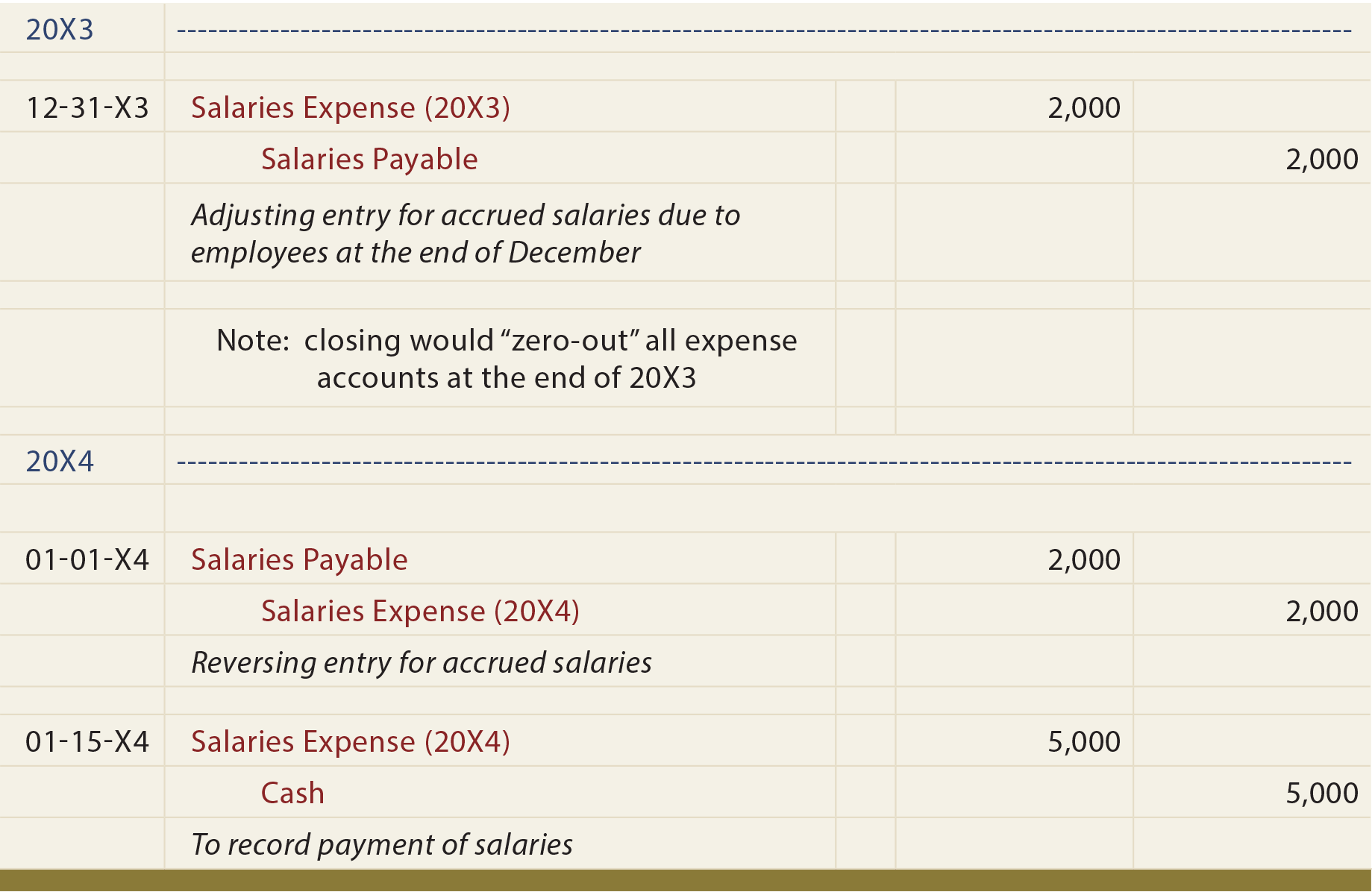

Reversing Entries Accounting Example Requirements Explained

Online Accounting Accounting Entry Accounting Journal Entries

Acg2021 Ch 4 Assignment Flashcards Quizlet

How To Prepare Adjusting Entries Accounting Principles Youtube

Undefined Principles Of Accounting Volume 1 Financial Accounting Openstax Cnx

Accounting An Introduction The Adjusting Entries Current And Long Term Assets

Undefined Principles Of Accounting Volume 1 Financial Accounting Openstax Cnx

The Adjusting Process And Related Entries Principlesofaccounting Com

The Adjusting Process And Related Entries Principlesofaccounting Com

The Adjusting Process And Related Entries Principlesofaccounting Com

Prepaid Expenses Definition Example Journal Entries Play Accounting

The Adjusting Process And Related Entries Principlesofaccounting Com

The Adjusting Process And Related Entries Principlesofaccounting Com

Online Accounting Accounting Entry Accounting Journal Entries

Solved 23 The Following Adjusting Journal Entry Does Not Chegg Com

The Adjusting Process And Related Entries Principlesofaccounting Com

Reversing Entries Principlesofaccounting Com

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Comments

Post a Comment