Adjusting Entry For Merchandise Inventory

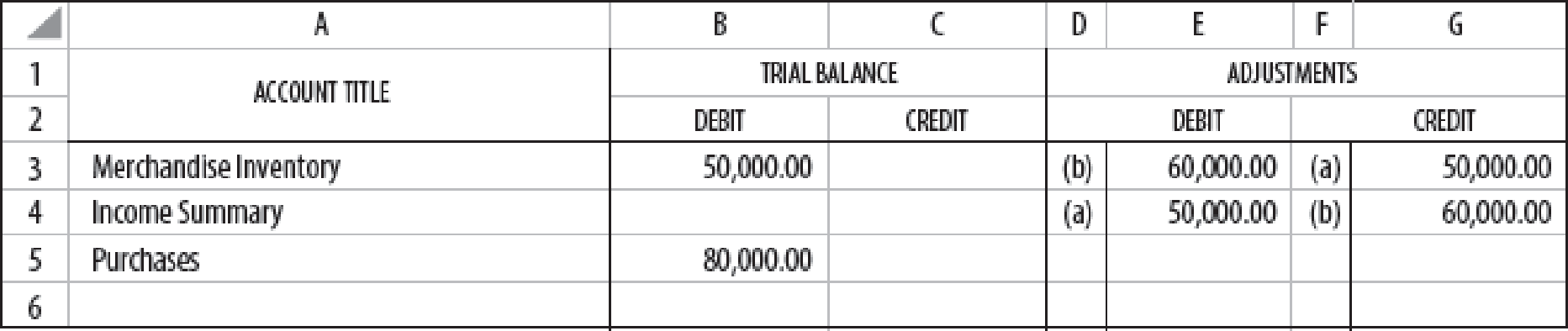

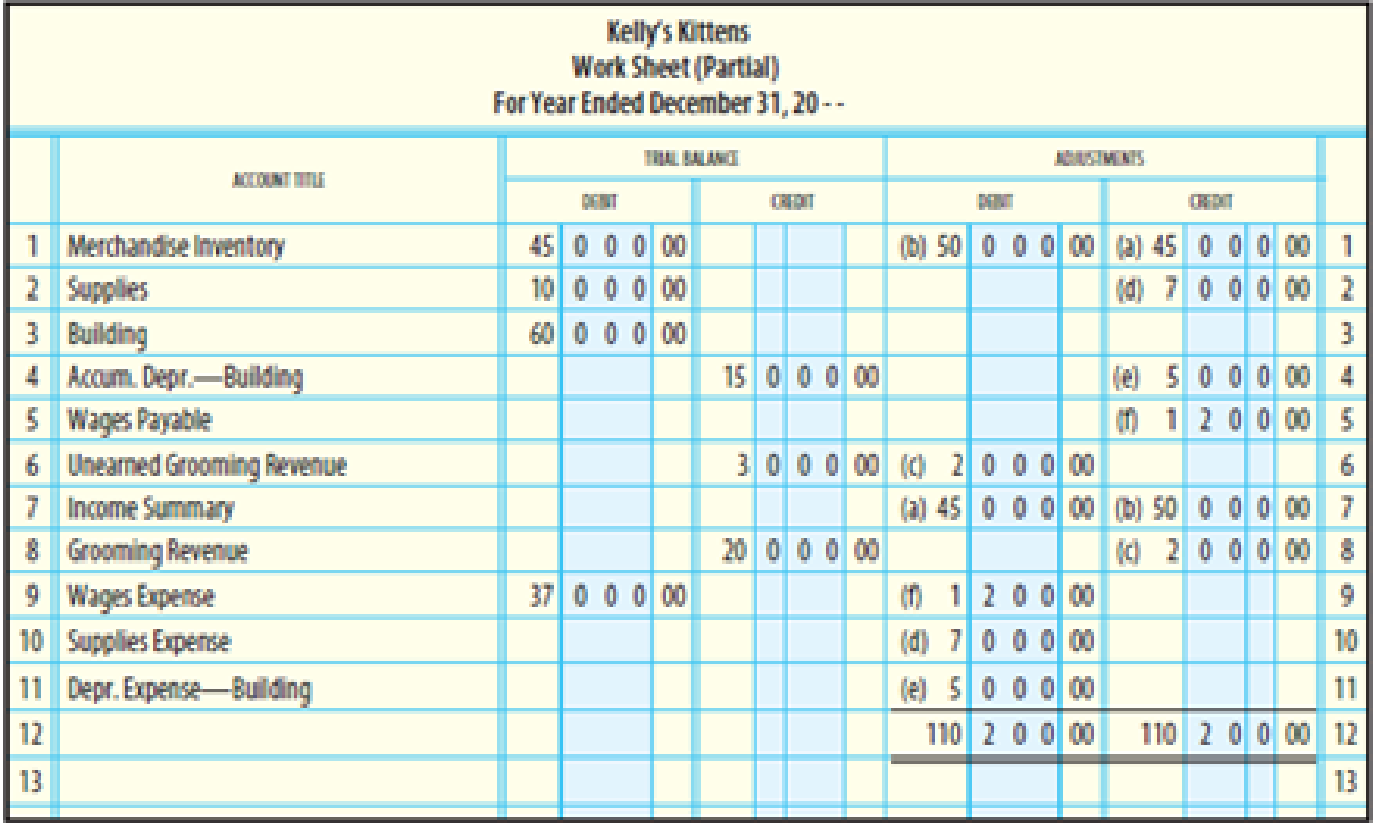

When supplies are bought during the year they are recorded by debiting increasing. In the second adjusting entry to enter the ending inventory debit Merchandise Inventory and credit Income Summary.

Analyzing And Recording A Merchandise Inventory Adjustment On A Worksheet 14 3 Wmv Youtube

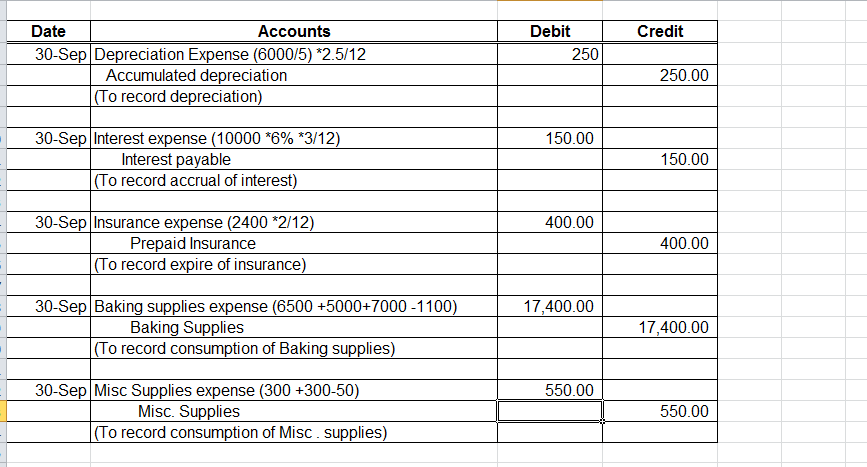

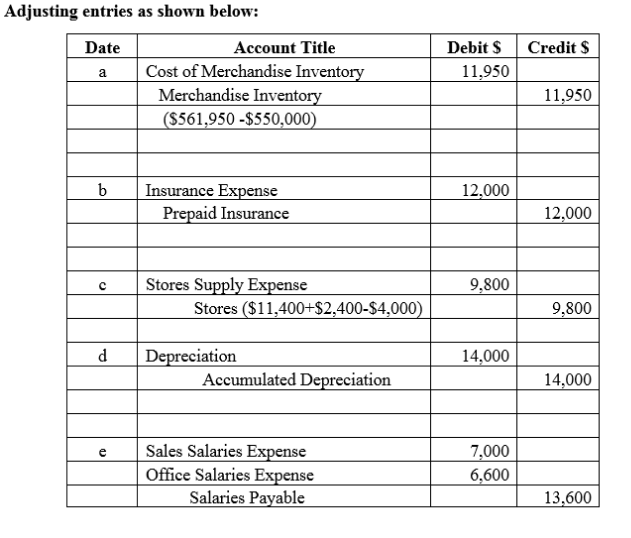

Work Sheet and Adjusting Entries Prepare an adjustment for supplies.

Adjusting entry for merchandise inventory. If a company has 100 items recorded on the books for 10 each but it figures the items are really worth only 6 each an adjusting entry needs to be made. First Merchandise Inventory Adjusting Entry. Suppose in the example above a stock-take revealed that the inventory was in.

If the ending merchandise inventory is 900 then the cost of goods sold is 600 1500 - 900. If the inventory account is updated during the closing entry process this closing entry includes a credit equal to the beginning inventory balance 37000 which increases the debit to income summary by a corresponding amount to 1068500. When the physical count is carried out an accurate value of the ending inventory is obtained and an adjusting entry can be made to correct the inventory account.

Subtract the ending merchandise inventory to get the cost of goods sold. 1 to make the income statement report the proper revenue or expense and 2 to make the balance sheet report the proper asset or liability. Debit the ending inventory balance to Merchandise Inventory and credit the Income Summary account.

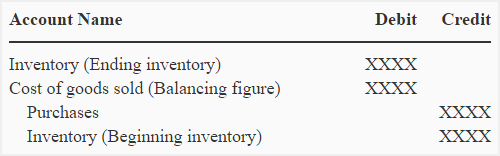

Basic Accounting - Adjusting Entry for Merchandise InventoryLearn how to prepare adjusting entry for merchandise inventoryReference. In summary beginning merchandise inventory and purchases are debits to income summary. The first adjusting entry clears the inventory accounts beginning balance by debiting income summary and crediting inventory for an amount equal to the beginning inventory balance.

Accrued meaning to grow or accumulate items and deferred. Merchandise inventory is the cost of goods on hand and available for sale at any given time. In this case an inventory loss journal entry of 400 would be debited to the Cost of Goods Sold account and 400 would be credited to the Inventory account.

Merchandise inventory also called Inventory is a current asset with a normal debit balance meaning a debit will increase and a credit will decrease. Thus every adjusting entry affects at least one income statement account and one balance sheet account. Each adjusting entry has a dual purpose.

It is acceptable to prepare a single adjusting entry which debits Estimated Returns Inventory and credits Refunds Payable. The second adjusting entry debits inventory and credits income summary for the value of inventory at the end of the accounting period. Adjusting entries fall into two broad classes.

In the first adjusting entry to remove the beginning inventory debit Income Summary and credit Merchandise Inventory. To determine the cost of goods sold in any accounting period management needs inventory information. Basic Accounting Made E.

2 acceptable methods are available the adjusting entry method and the closing entry method. Ending inventory from goods available for sale because both purchases and beginning inventory are entered on the debit side. At the time a firm adjusts Merchandise Inventory the Income Summary account a.

For example if the beginning merchandise inventory balance is 1000 and purchases during the period are 500 then goods available for sale equals 1500 1000 500. When adjusting entries are used two separate entries are made. Prepare an adjustment for merchandise inventory under the periodic inventory system.

This is performed by the following two adjusting entries. Contains the last fiscal periods adjusting entry for Merchandise Inventory. Second Merchandise Inventory Adjusting Entry.

While ending merchandise inventory is a credit to income summary. If you run your business on a cash basis you enter a direct adjustment by debiting COGS and crediting inventory for the loss amount. Debit the beginning inventory balance to Income Summary and credit the Merchandise Inventory account.

Periodic Inventory System Explanation Journal Entries Play Accounting

Merchandising Companies Adjusting Entries Youtube

Solved Merchandise Inventory Physical Count At The End Is Chegg Com

Adjusting The Inventory Account

Chapter 16 Recording Adjusting And Closing Entries For A Corporation Ppt Download

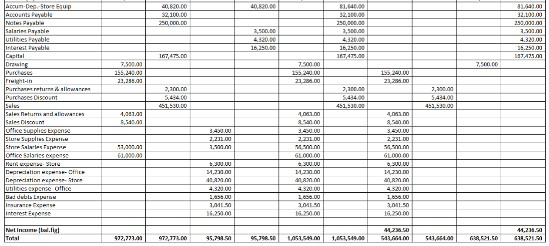

Merchandise Inventory Adjustments Periodic Inventory System With Sales Returns And Allowances Use The Information Provided Below To Prepare A Partial End Of Period Spreadsheet For Karen S Gift Shop For The Year Ended December 31

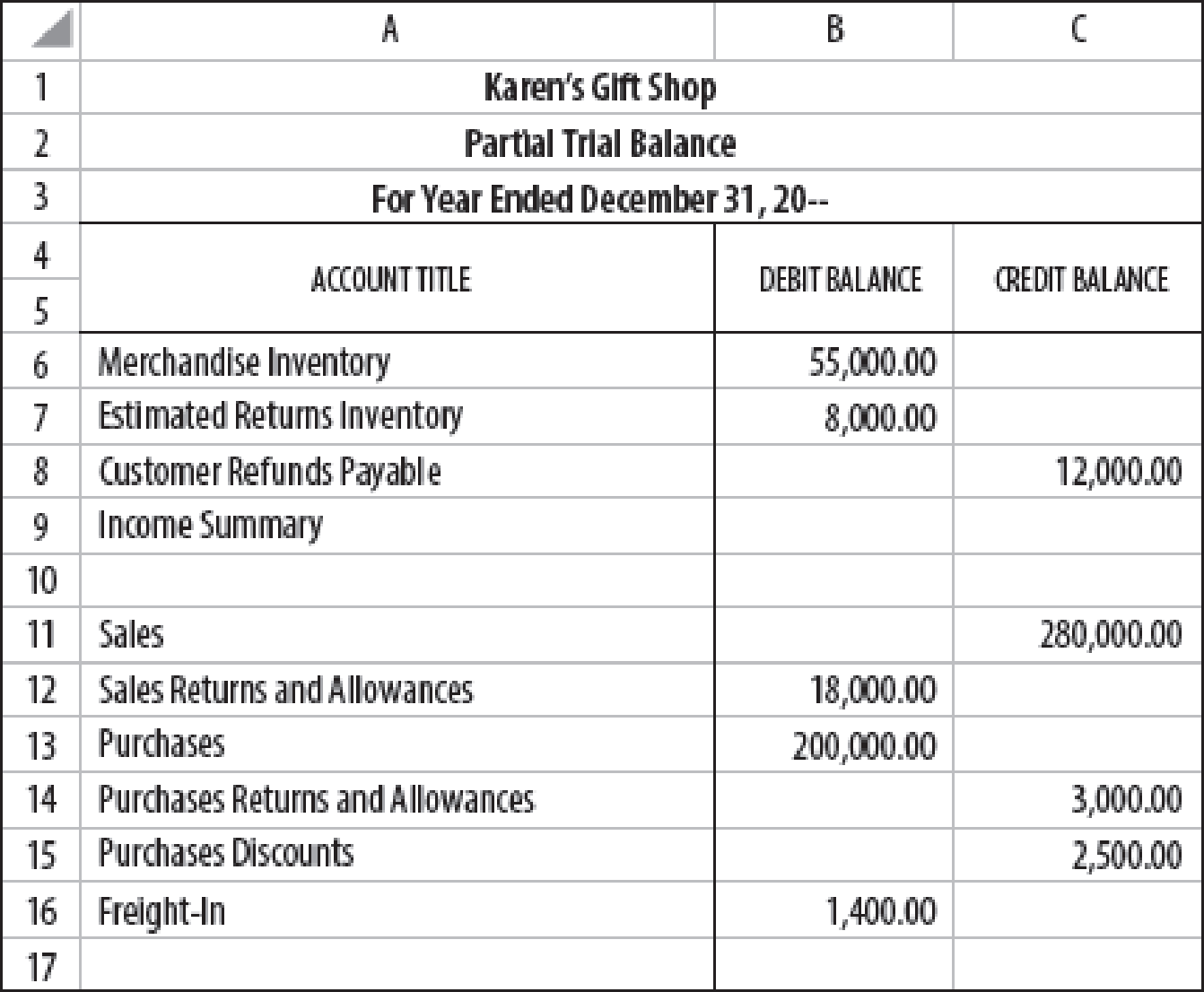

Periodic Inventory System Explanation Journal Entries Example Accounting For Management

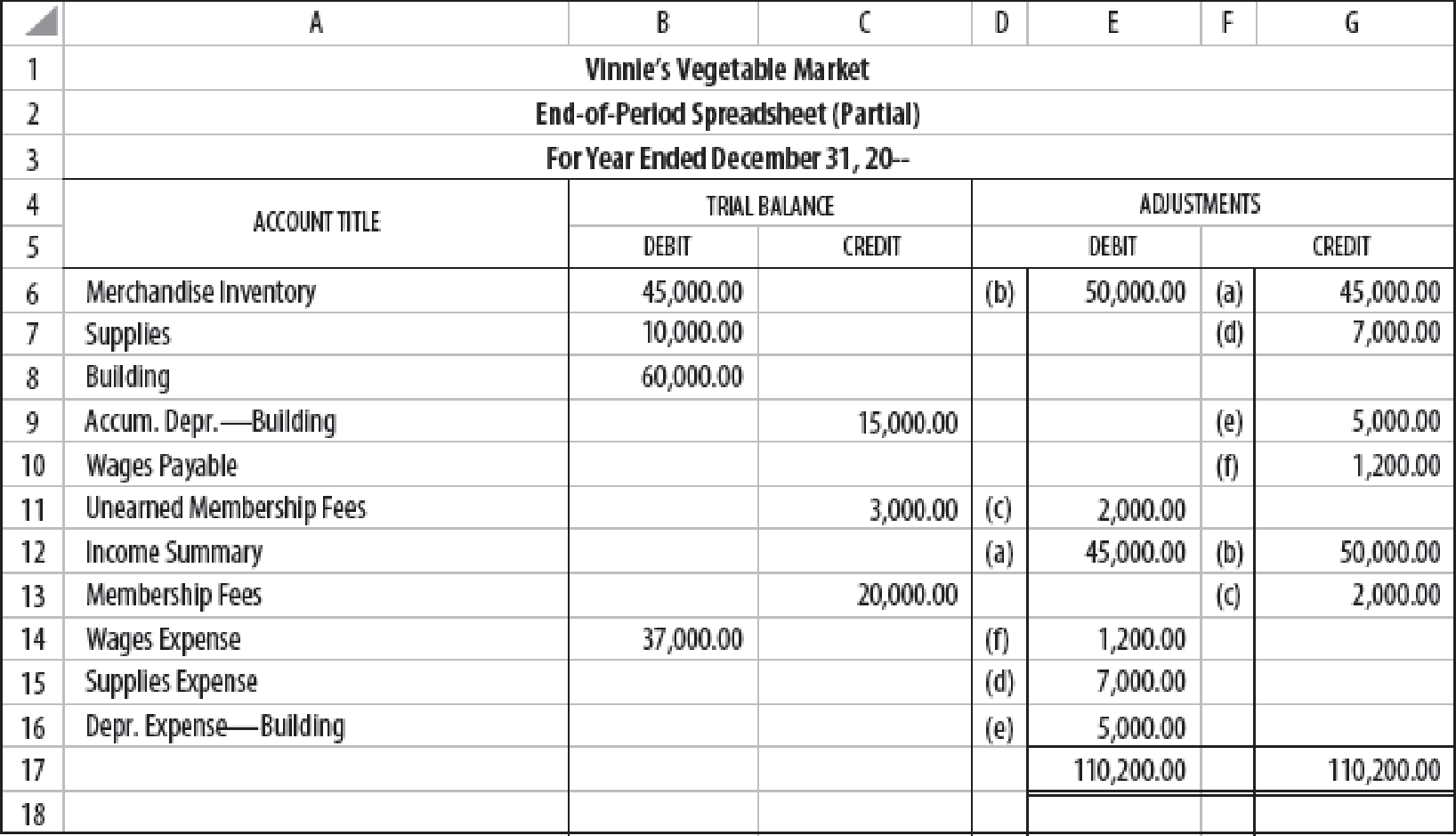

Journalize Adjusting Entries For A Merchandising Business The Following Partial Spreadsheet Is Taken From The Books Of Vinnie S Vegetable Market For The Year Ended December 31 20 Journalize The Adjustments In A

Peyton Approved Trial Balance 2018 Unadjusted Tria Chegg Com

Periodic Inventory System Explanation Journal Entries Play Accounting

Periodic Inventory System Explanation Journal Entries Example Accounting For Management

Periodic Inventory System Explanation Journal Entries Play Accounting

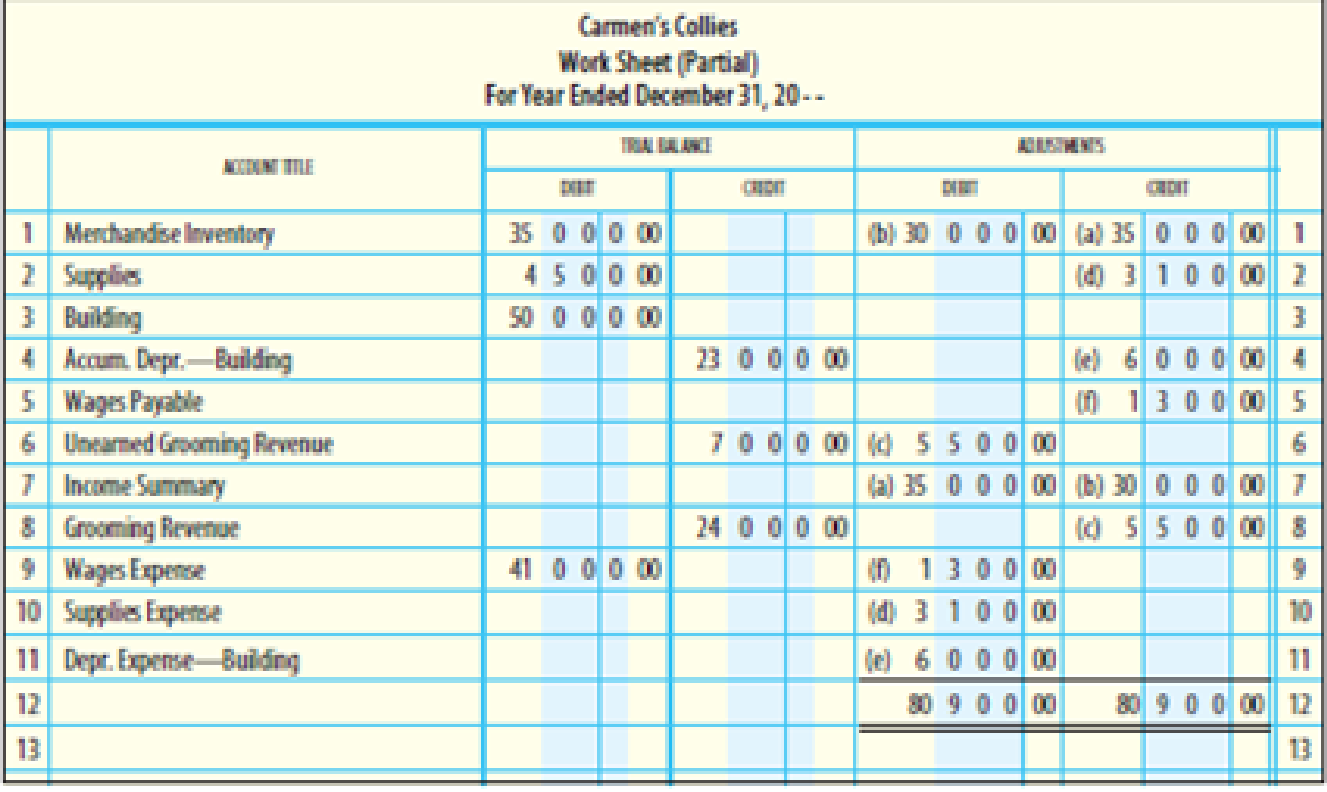

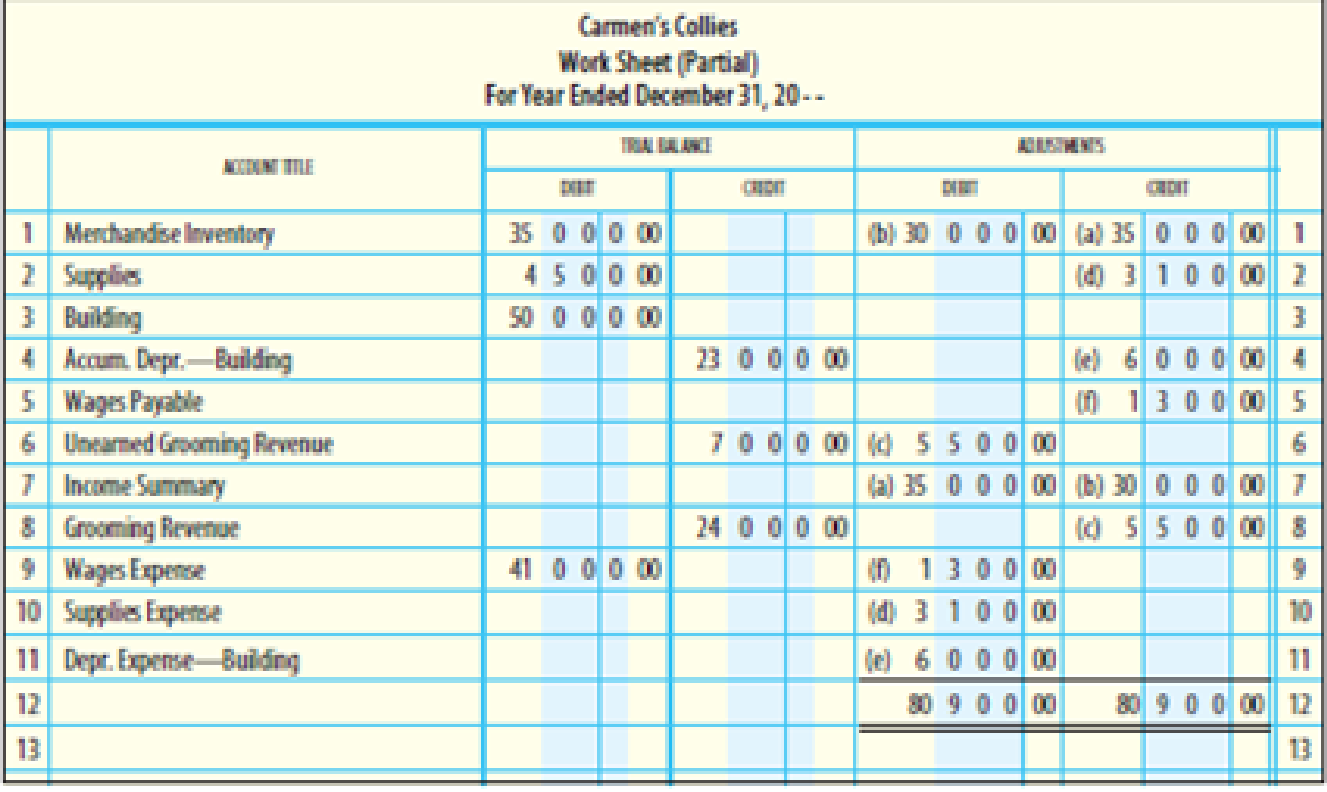

Journalize Adjusting Entries For A Merchandising Business The Following Partial Work Sheet Is Taken From The Books Of Carmen S Collies A Local Pet Kennel For The Year Ended December 31 20 Journalize

Using The Spreadsheet Provided Below Prepare The Adjusting Entries For Merchandise Inventory Bartleby

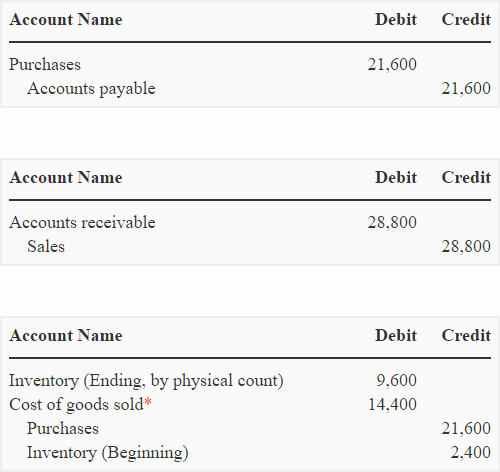

Solved Continuing Problem 8 Net Income 777ls Palisade C Chegg Com

Adjusting Entries Recorded In A Journal 2 1

Glencoe Mcgraw Hill Financial Statements And Closing Procedures Ppt Download

Journalize Adjusting Entries For A Merchandising Business The Following Partial Work Sheet Is Taken From The Books Of Kelly S Kittens A Local Pet Kernel For The Year Ended December 31 20 Journalize

Comments

Post a Comment